By comparing anticipated and actual cash flows, the accuracy of a cash flow prediction should be verified regularly. It's also important to remember that predicting doesn't stop once the forecast is live. If senior management shows great commitment to the forecasting process, stakeholders are more likely to interact with it, and the prediction is more likely to provide value. To make the cash flow forecasting process easier, the forecaster must make sure that people who must provide information understand the forecast's importance and the level of detail required.Īnother thing to think about is whether or not you need executive sponsorship. To address these difficulties, businesses should assess how they can improve the data collection process and employ technology to increase the accuracy and timeliness of the resulting prediction. Furthermore, a precise and timely forecast might help the forecaster increase his or her profile and reputation among key business players.Ĭompanies, on the other hand, often have difficulty accurately forecasting their cash flows, particularly if they operate in many countries and currencies.Ĭash Flow Forecasting will need to acquire accurate, up-to-date data from a variety of sources throughout the organisation to develop an accurate cash flow projection. You can also plan for any potential cash shortages and better manage foreign exchange risk. With an accurate cash flow prediction, you can lower the cash buffer required for unanticipated expenses and make better use of your company's surplus cash. Predicting your cash position should be a top priority for any company since it allows you to monitor your cash flow, plan for potential cash flow concerns, and make better decisions.Ĭash Flow Forecasting, at its most basic level, can tell you whether you'll have positive cash flow (more money coming in than going out) or negative cash flow (more money going out than coming in) at any given time. The longer the time horizon of a cash flow prediction, the less accurate it is expected to be. A short-term cash forecast can be used to identify any impending financial needs or excess funds during the following 30 days.ĭepending on the nature of the company, a medium-term Cash Flow Forecasting might look at sales and purchases for the next month to a year, while a long-term forecast might look at sales and purchases for the following year to five years or even longer. How Can Automation Help With Cash Flow Forecasting?Ĭash flow forecasting, often known as cash forecasting, is a means of predicting the movement of cash into and out of your company over a certain period and across all areas.Ī Cash Flow Forecasting shows how much money you'll have depending on your revenue and expenses, and it's a crucial tool for making funding, capital expenditures, and investment decisions.Ĭash Flow Forecasting can be done for a range of periods.

Profits aren't the same thing as cash flow.

What is the best way to forecast your cash flow?.What is a cash flow forecast's purpose?.Loan repayments, the sale of non-essential assets, refunds, and grants are all possibilities. The most prevalent source of cash flow is money earned from sales.

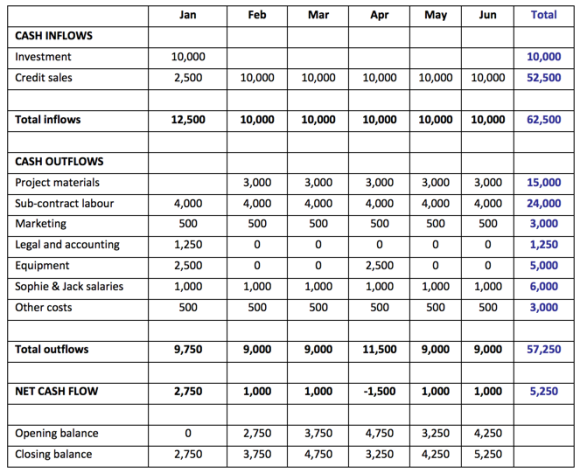

However, in larger companies, the process of generating a prediction involves input from a variety of stakeholders and data sources. It's beginning cash plus projected inflows minus projected outflows equals ending cash.Ĭash flow forecasting is the practice of estimating the flow of cash in and out of a firm over a specified period.īusinesses can forecast future financial positions, avert crippling cash shortages, and maximise revenues on any cash surpluses they may have with accurate cash flow forecasting.Ĭash flow forecasting is responsibility of a company's finance department. Do you know the formula for calculating cash flow forecasts?

0 kommentar(er)

0 kommentar(er)